The new tax policies haven’t even taken effect yet and already the tax avoidance maneuvering has begun. In a Reuters article this week it was reported that, “A wave of energy companies has in the last few months announced plans to move to Switzerland — mainly for its appeal as a low-tax corporate domicile that looks relatively likely to stay out of reach of Barack Obama’s tax-seeking administration.” Gee, I never would have expected that.

Common Sense tells you that when you raise taxes the incentive to avoid taxation goes up. The greater the incentive (higher taxes) the greater the lengths companies and individuals will go to avoid them. Let me emphasize my point through some good old fashioned exaggeration…

Most of us pay 10-20% of our wages in income tax (I’m referring to the net number after deductions – more on taxation another time), and the vast majority of us don’t go to any exceptional lengths (certainly not any illegal lengths) to avoid paying those taxes. Now imagine that beginning in 2010 your tax rate was 80% or 90% or even 99% (of course I’m exaggerating, but do you see where this is going), what would you do? Call me crazy but it seems quite obvious; a person would either get very creative in avoiding taxation or simply throw their hands up and stop earning all together cause what’s the point, right?

So, in the end the argument isn’t about whether to tax the rich or tax the poor or tax corporations. Those are the proverbial weeds the politicians try to mire you down in to obscure the real story. And what’s that story?

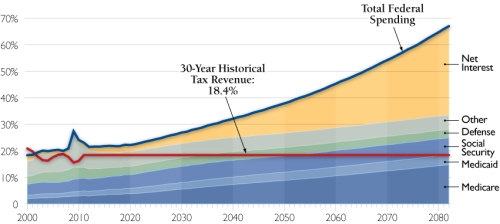

THEY’RE SPENDING MORE THAN THEY’RE TAKING IN!

And they’re doing it EVERY YEAR!

The real discussion that needs to take place is how to raise the necessary revenue (and we better start reducing that “necessary” number) yes fairly, but more importantly, effectively. If you raise taxes and taxpayers change their behaviors to avoid the tax, a government can actually end up generating less revenue rather than more. If the government raises taxes on corporations such as the energy companies mentioned in the Reuters article and those companies move overseas the tax increase that was sold to the American people as a solution actually makes things worse. The Treasury loses the tax revenue they were collecting. Americans working for the companies are likely to lose their jobs and the Treasury loses the resulting income tax. The real estate these companies were renting in the U.S. is now vacant leading to lost income for the landlord, or lost property tax revenue for the local community or both. And the list goes on and on and on and on with a trickle down effect of lost jobs and lost tax revenue on all the supporting services that surround a major employer – gas stations, restaurants, coffee shops, etc. etc.

So, the next time you hear a politician tell you that they’re going to fix everything by raising taxes on somebody else, stop and think for a minute about what the consequences of that tax increase might actually be. Because, I’m telling you, people with Common Sense should see this stuff coming!